|

|

Post by worksforme2 on Apr 19, 2022 5:52:12 GMT -5

Secret Service criticized again as senile old man spotted on White House lawn waving a gun and speaking incoherently....... Attachments:

|

|

|

|

Post by worksforme2 on Jun 10, 2022 14:59:27 GMT -5

For those of you who do not live in the US here's just a blip to keep you up to speed. Inflation is rocking and rolling. The 8.4 % for May is really not the real story, although it looks to be enough to take the markets down about 2 and 1/2% today.

I did a bit of commerce with Lowe's today. I am doing maintenance on the wooden steps off my screened in porch that take me to ground level. Cabot's stain has gone up to $45 a gallon. Cabot's is the stain that Lowe's sells. A couple years ago I remember stain being around $25. And Thompson's Wood Sealer is up to $19.78/gallon. Gasoline is $4.45 a gallon here. When trump left it was $2.05. Don't ask me about what is happening with food. You don't want to know. Thanks, Sleepy Joe.

|

|

|

|

Post by greatcoastal on Jun 10, 2022 17:00:55 GMT -5

For those of you who do not live in the US here's just a blip to keep you up to speed. Inflation is rocking and rolling. The 8.4 % for May is really not the real story, although it looks to be enough to take the markets down about 2 and 1/2% today. I did a bit of commerce with Lowe's today. I am doing maintenance on the wooden steps off my screened in porch that take me to ground level. Cabot's stain has gone up to $45 a gallon. Cabot's is the stain that Lowe's sells. A couple years ago I remember stain being around $25. And Thompson's Wood Sealer is up to $19.78/gallon. Gasoline is $4.45 a gallon here. When trump left it was $2.05. Don't ask me about what is happening with food. You don't want to know. Thanks, Sleepy Joe. $4.89 today ,as I traveled much of Central Fl. Same price within a 150 mile radius. ($5.67 and $5.90 for diesel) |

|

|

|

Post by baza on Jun 10, 2022 20:21:10 GMT -5

Australia at the moment, petrol is about $ 2 a litre.

That translates into $ 7:60 per US gallon.

|

|

|

|

Post by greatcoastal on Jun 10, 2022 22:33:16 GMT -5

California has the highest average price, at $6.40 a gallon, according to AAA.

|

|

|

|

Post by worksforme2 on Jun 11, 2022 5:54:59 GMT -5

Biden Administration to offer grief counselling to motorists filling their cars...mental health experts "very" concerned Attachments:

|

|

|

|

Post by worksforme2 on Jun 11, 2022 15:28:50 GMT -5

Australia at the moment, petrol is about $ 2 a litre. That translates into $ 7:60 per US gallon. Lots of countries and even states in the US have significantly higher gasoline prices than here in NC. But that doesn't make me feel any better about what I am seeing at the pump. A yr. and 1/2 ago the US was energy independent. Now the US is begging every two bit dictator around the globe for some fuel. Sleepy Joe is trying to blame Putin for inflation, but no one is buying what he's selling, and rightly so. |

|

|

|

Post by heelots on Jun 11, 2022 16:49:48 GMT -5

Australia at the moment, petrol is about $ 2 a litre. That translates into $ 7:60 per US gallon. Lots of countries and even states in the US have significantly higher gasoline prices than here in NC. But that doesn't make me feel any better about what I am seeing at the pump. A yr. and 1/2 ago the US was energy independent. Now the US is begging every two bit dictator around the globe for some fuel. Sleepy Joe is trying to blame Putin for inflation, but no one is buying what he's selling, and rightly so. I could not agree more. Fuel prices in other countries means nothing here. By saying that I mean no disrespect to other ILIASM members, or the country's the live in. |

|

|

|

Post by deadzone75 on Jun 11, 2022 22:42:00 GMT -5

Australia at the moment, petrol is about $ 2 a litre. That translates into $ 7:60 per US gallon. Lots of countries and even states in the US have significantly higher gasoline prices than here in NC. But that doesn't make me feel any better about what I am seeing at the pump. A yr. and 1/2 ago the US was energy independent. Now the US is begging every two bit dictator around the globe for some fuel. Sleepy Joe is trying to blame Putin for inflation, but no one is buying what he's selling, and rightly so. The narrative shifts. First it was Putin's fault, nobody bought it so they blamed Super MAGA Supporters, then he tried to say this is all on purpose so we can have clean energy, now it's just "it's gonna suck for a long time". |

|

|

|

Post by heelots on Jun 11, 2022 22:50:56 GMT -5

I put all of the blame on slo Joe, heel up Harris, and the Democrats who I fully expect to take a royal shellacking in the next election because of it.

The economy is in the shitter and the Dems are going to pay for that!

|

|

|

|

Post by mirrororchid on Jun 13, 2022 6:31:33 GMT -5

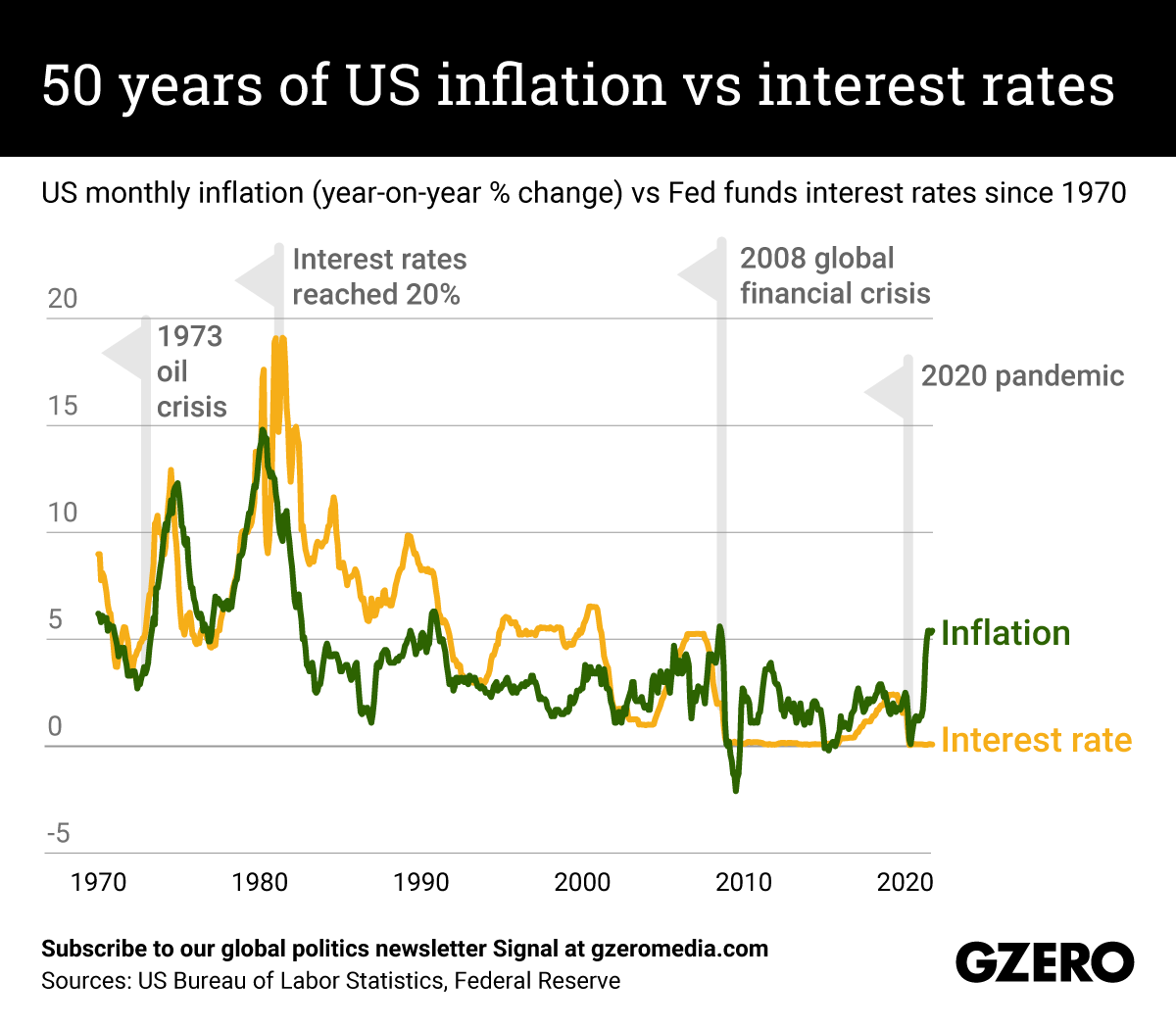

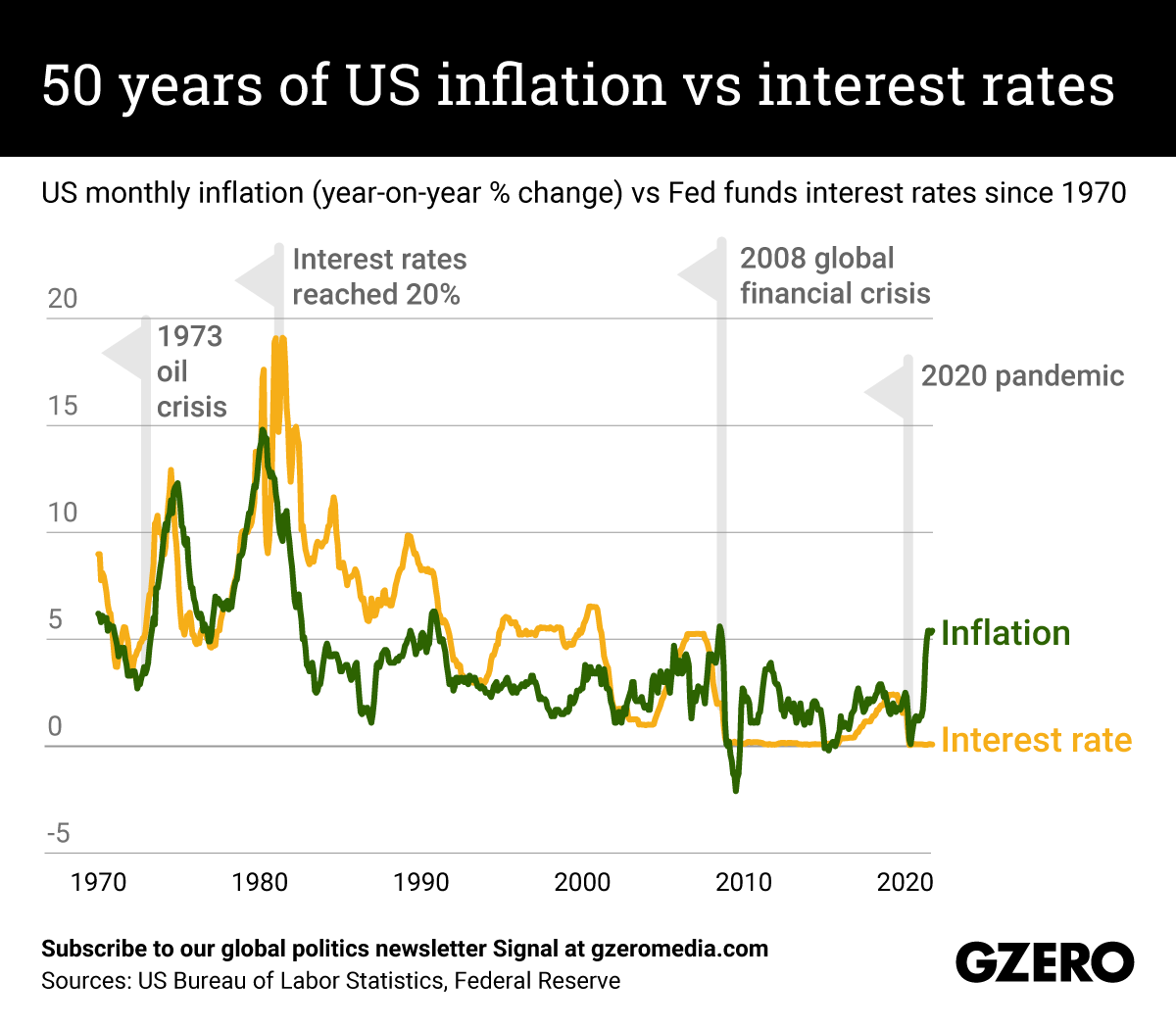

I put all of the blame on slo Joe, heel up Harris, and the Democrats who I fully expect to take a royal shellacking in the next election because of it. The economy is in the shitter and the Dems are going to pay for that! If this economy is in the shitter, where was the economy in 2009? If we're concerned about inflation, we're supposed to be relieved when housing prices start coming down and teh stock market slips 20%. Some folks complain cheap money is causing a bubble, then when air escapes they scream the economy is tanking. If there is no path to a "win", all complaints become noise. Unemployment is at 3.6%. 0.1% higher than Donald Trump's best number. Biden came in with 6.2% I blame COVID, not Trump, for that but the restoration of extremely low unemployment would be praiseworthy if it weren't our dodderer in chief. Note how both the Reagan and Clinton economies experienced interest rates higher than inflation. ('80-'88 and '92-2000) Just before teh pandemic, interest rates had climbed higher than inflation. We might have experienced a good economic period if not for teh bad luck. The interest rate now in place was suitable for the pandemic but was kept absurdly low even as everyone went back to work. The rate increase was too slow and, if history is a good guide, should be increased maybe as high as 10% to surpass inflation. This makes some sense. If saving money in a CD or savings bond loses you purchasing power, why wouldn't you invest it in something riskier of buy things like real estate and gold? We may need interest rates north of 10% so socking money away and removing it from teh economy cools the enthusiasm of teh masses. The gap between interest rates and inflation has never been this large and the gap for perhaps the last year has been uncharacteristic. The only comparable periods were the GreatRecession and the 9/11 slump/dot com crash. We're been recovering since before Biden took over and no brakes were applied. The speedy recovery was teh goal and it's been accomplished. Now we're overshooting. Not as bad a problem as a recession, but intervention has been a bit late and may indeed be advantageous for the GOP if teh timing works out teh way you think. The problem is that just a half point clobbered the indices by 20%. It's a tightrope walk and we've not had many opportunities to practice the adjustments. Five months may change teh picture dramatically. Are subtle cues enough? Or will aggressive action be needed? Are people plowing through their savings and credit lines and both will crash simultaneously causing a sudden reversal to a glut in goods and services? Entirely possible, if not probable.  |

|

|

|

Post by heelots on Jun 13, 2022 9:00:01 GMT -5

I put all of the blame on slo Joe, heel up Harris, and the Democrats who I fully expect to take a royal shellacking in the next election because of it. The economy is in the shitter and the Dems are going to pay for that! If this economy is in the shitter, where was the economy in 2009? If we're concerned about inflation, we're supposed to be relieved when housing prices start coming down and teh stock market slips 20%. Some folks complain cheap money is causing a bubble, then when air escapes they scream the economy is tanking. If there is no path to a "win", all complaints become noise. Unemployment is at 3.6%. 0.1% higher than Donald Trump's best number. Biden came in with 6.2% I blame COVID, not Trump, for that but the restoration of extremely low unemployment would be praiseworthy if it weren't our dodderer in chief. Note how both the Reagan and Clinton economies experienced interest rates higher than inflation. ('80-'88 and '92-2000) Just before teh pandemic, interest rates had climbed higher than inflation. We might have experienced a good economic period if not for teh bad luck. The interest rate now in place was suitable for the pandemic but was kept absurdly low even as everyone went back to work. The rate increase was too slow and, if history is a good guide, should be increased maybe as high as 10% to surpass inflation. This makes some sense. If saving money in a CD or savings bond loses you purchasing power, why wouldn't you invest it in something riskier of buy things like real estate and gold? We may need interest rates north of 10% so socking money away and removing it from teh economy cools the enthusiasm of teh masses. The gap between interest rates and inflation has never been this large and the gap for perhaps the last year has been uncharacteristic. The only comparable periods were the GreatRecession and the 9/11 slump/dot com crash. We're been recovering since before Biden took over and no brakes were applied. The speedy recovery was teh goal and it's been accomplished. Now we're overshooting. Not as bad a problem as a recession, but intervention has been a bit late and may indeed be advantageous for the GOP if teh timing works out teh way you think. The problem is that just a half point clobbered the indices by 20%. It's a tightrope walk and we've not had many opportunities to practice the adjustments. Five months may change teh picture dramatically. Are subtle cues enough? Or will aggressive action be needed? Are people plowing through their savings and credit lines and both will crash simultaneously causing a sudden reversal to a glut in goods and services? Entirely possible, if not probable.  Spin things to your liking mirrorchild, the fact remains the same. The economy is in the tank and fuel prices are the worst they have ever been and the Dems are driving the bus. Result is the same, they get the blame for where the eco omy is today, end of story. |

|

|

|

Post by mirrororchid on Jun 14, 2022 5:16:29 GMT -5

Spin things to your liking mirrorchild, the fact remains the same. The economy is in the tank and fuel prices are the worst they have ever been and the Dems are driving the bus. Result is the same, they get the blame for where the economy is today, end of story. If unemployment rises to 4% but gas goes down to $4.00 a gallon. Is that better or worse? What inflation rate would signal a "job well done" for the bumbling Democrats? I'm inviting metrics. Criticizing your opponent without reasons is of limited credibility. Since you invite me to spin things, adjusted for inflation, George W. Bush's administration saw $5.40 per gallon. The highest price to this date. I'll congratulate you when current prices hit $5.41 (maybe $5.46...inflation adjusted. Recursive math is tricky.) As for spin, I think I've said interest rates should have been goosed some time ago. I'm not just rainbows and sunshine here. When inflation hits 4%, it's time to hit the brakes. www.thebalance.com/u-s-inflation-rate-history-by-year-and-forecast-3306093Checking a different resource, Clinton was north of 2.5% 6 of eight years. Not the 4-6% I thought I'd seen elsewhere. 7 of 8 years of Reagan were over 3.8%. 6 of the 7 topped out at 4.4% though after Volcker strangled inflation in 1981. It seems fair if Biden lowered inflation to 4.4% and kept the 3.6% unemployment rate, that'd be a pretty nifty trick, beating Ronald Reagan. Neither of us will hold our breath, but let's set goalposts, shall we? Curious to note, the fed Rate was lower than inflation during teh Caryter years. The ones people complain the loudest about. The fed rate only went lower than inflation again in 2002, after the late 2001 dot com/9-11 crash started to slow the US and the world down. Inflation, theoretically, would help get people spending again. 2003 started a run up of housing which got it's own momentum even in 2005 when Dubya (wisely) jacked up rates a full 2% in a single year. The real estate insanity continued and Bush lowered rates to almost the rate of inflation for a reason I cannot quite get. Lowered interest rates may have allowed teh real estate bubble to extend its run until it all came down in 2008. Despite almost free money, inflation stayed below 2.1% for 6 of the eight years of Obama's term. No great joy given the sluggish economy (low inflation and sluggish economies commonly go together). Trump's term kept rates lower than the prevailing 2% inflation adding momentum to a half-decent economy of 2016. 2021's COVID remission opened the economy with a lot of saved money and repaired credit lines. An inflation spike was inevitable. Scare talk of interest rate increases stopped working and the economy grew anyway, so Powell pulled the trigger. May need another 2% like Dubya did in 2005 and a deliberate micro-recession. Quick and small. To disperse the idea that inflation is something to worry about long term. It is, but only if Powell and the Fed all lose their minds. |

|

|

|

Post by ironhamster on Jun 15, 2022 8:38:31 GMT -5

I am pretty frustrated with the government's financial stupidity. Interest rate increases reduce consumption, but ALL of our inflation issues are supply side. China shutdowns. Covid shutdowns. Destroying the American oil industry. Printing money for everybody but those that earn it. None of that is fixed by putting people out of work. We should be holding interest rates low. Getting 2% when inflation is 8% sucks, but the alternative is worse.

I did not like this administration from the get-go, because Biden told us what his plans were. I regretfully believed that the wealthy people that put him in power would hold him back. Nobody has any idea how bad this is going to get.

|

|

|

|

Post by heelots on Jun 15, 2022 11:54:45 GMT -5

I am pretty frustrated with the government's financial stupidity. Interest rate increases reduce consumption, but ALL of our inflation issues are supply side. China shutdowns. Covid shutdowns. Destroying the American oil industry. Printing money for everybody but those that earn it. None of that is fixed by putting people out of work. We should be holding interest rates low. Getting 2% when inflation is 8% sucks, but the alternative is worse. I did not like this administration from the get-go, because Biden told us what his plans were. I regretfully believed that the wealthy people that put him in power would hold him back. Nobody has any idea how bad this is going to get. I never believed anything slo Joe said. |

|